Lawhorn CPA Group, LLC is a national network of professional services firms offering Tax, Accounting, Consulting, and Advisory services for individuals, businesses, and nonprofits.

Our mission is to assist you in reaching your financial goals by providing customized, strategic, and cost-effective solutions. Striving to be more than just your accountants, our goal is to become your trusted advisor and an extension of your team.

With a commitment to rigorous quality and competency standards, we will guide you successfully through your financial journey, helping you overcome obstacles and achieve your goals.

Over the past decade, we have made considerable investments in information technology, process improvements, and cloud-based technology to bring you even more services that you need at a fair price.

Whether you need a business health check, want to save money on taxes, or simply seek to improve results, contact us today to discover how easy it can be with the right team.

Back Office Support

Accounts payable and accounts receivable (AP/AR) cash and asset management, bank and credit card reconciliation, payroll services, and accounting software solutions.

Tax Planning + Consulting

A complete analysis of your financial situation and development of a comprehensive tax plan to guarantee tax efficiency.

Business Task Automation

Automate your basic business processes saving time and money freeing up your staff to perform more high-value and impactful work .

Tax Preparation/The Compliance ACT

Our team of accounting and tax specialists will ensure the financial accuracy and legal compliance of your tax filings.

Financial + Accounting Reporting

Financial and accounting reporting providing real-time information including income statements, balance sheets, and statements of cash flow, all in real time.

IRS Tax Representation

We interact with tax authorities on your behalf, provide information and explanations, and even negotiate agreements with those agencies for you.

Financial Advisory

Risk management planning and effective tax planning strategies designed around your life, income, and investments.

Accounting Software Solutions

Accounting software selection, integration, and training, combined with continuous learning and advanced troubleshooting.

WHO WE ARE

Headquartered in Knoxville, TN, Lawhorn CPA Group, LLC offers a wide range of comprehensive business and individual accounting-related services. Just like each member of our professional team, every business and individual we serve is unique. We proudly personalize our services to create tailored solutions for your accounting, tax, cloud integration, and financial decision-making needs.

Our aim at Lawhorn is to help you better manage and optimize your financial results by providing customized, strategic, and cost-effective solutions. Striving to be much more than just your accountants, we want to become an extension of your team.

Value-Based Pricing

The time Has Come

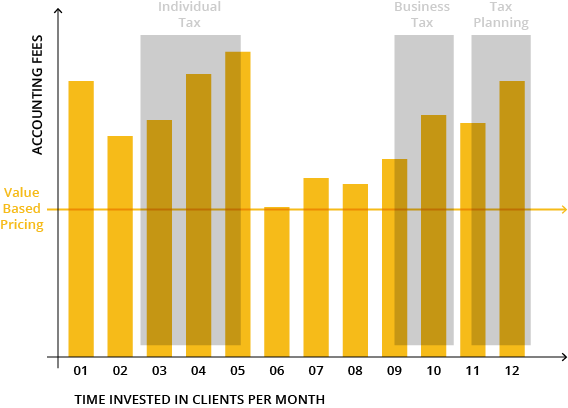

Lawhorn CPA Group has long recognized that conventional time & rate-based pricing methods employed by many professional services providers fail to adequately serve client needs. In fact, this archaic and often murky pricing discouraged communication, was difficult to plan for, lacked transparency, placed the entire burden of risk on clients, and was not conducive to the spirit of a true partnership.

Instead, we use a value-based approach. We meet with you and agree on an annual scope of services on the front end. Billing can be arranged to be monthly, quarterly, semi-annually, or however best suits your needs. Any advice or counsel you need, when you need it, is always included in our agreements and does not result in additional consultation fees.

Value-Based Pricing

The time Has Come

Lawhorn CPA Group has long recognized that conventional time & rate-based pricing methods employed by many professional services providers fail to adequately serve client needs. In fact, this archaic and often murky pricing discouraged communication, was difficult to plan for, lacked transparency, placed the entire burden of risk on clients, and was not conducive to the spirit of a true partnership.

Instead, we use a value-based approach. We meet with you and agree on an annual scope of services on the front end. Billing can be arranged to be monthly, quarterly, semi-annually, or however best suits your needs. Any advice or counsel you need, when you need it, is always included in our agreements and does not result in additional consultation fees.

01

LATEST TOOLS

Lawhorn CPA Group diligently invests in state-of-the-art technology and communication tools that make it easy for clients to collaborate with their CPA-led team.

02

HOLISTIC APPROACH

Not only do we provide expertise to manage your organization’s tax, accounting, and other critical financial functions, our affiliated companies have been designed around providing solutions for other key areas of your business and life.

03

GOAL FOCUSED

Lawhorn CPA Group is comprised of hard-working professionals that combine experience, technical skill, and business savvy. Our objective is to produce tangible results that exceed our client’s financial goals. Your organization is in the trusted and experienced hands of CPAs and accountants that understand the demanding environment of operating a business today.

04

MULTIPLE INDUSTRY EXPERIENCE

Lawhorn CPA Group’s accounting experts are versed in a wide array of industries and company sizes.

05

TEAM APPROACH

Our team approach to serving clients increases the points of contact, aggregates our expertise and knowledge bases and decreases the dependence and risk that comes with being connected with only one individual.

06

ACCOUNTING EXPERTISE

Seldom will you find a professional services firm that affords business owners and decision-makers direct access to so many different experts under one roof. From accounting and planning to CFO level services, whatever your business needs are, we have you covered.

FINANCIAL ADVISORY SERVICES

Financial advisory services offered by the experts at Lawhorn CPA Group provide valuable advice and guidance on investment management, tax planning, estate planning, and personal finance.

INDIVIDUAL TAX PLANNING AND PREPARATION

Experts in accounting offer numerous benefits, including saving time and money, helping you reduce debt, and improving your credit rating. CPAs will continue to be instrumental in helping guide businesses and individuals through ever-changing tax laws.

Individuals who utilize investments or rental properties, for example, to secure financial freedom benefit greatly from the advice of a professional accountant. Additionally, if you earn more than $150,000 per year or have numerous sources of income, engaging an accountant for tax preparation can help reduce the likelihood of an IRS tax audit and provide insightful financial advice.

If you are saving for college, recently inherited cash or property, are preparing to make a significant financial gift, or owe back taxes to the IRS, the expert eye of an accountant can help you maximize your tax deductions, ensure financial growth, and secure a positive financial future.

BUSINESS ACCOUNTING

One of the primary causes of business failure is poor financial management. Whether a new or established company, every business should protect itself by engaging the financial and tax expertise of an accountant. A skilled accountant can assist in business planning, strategic tax planning, and can even operate as the finance/accounting department of your organization.

Lawhorn CPA Group does much more than file taxes. By hiring our accounting firm, you will ensure you take advantage of all business deductions available, take necessary steps to avoid audits, obtain salient financial information necessary to make informed business decisions, effectively plan for the future of your company, and most of all, save time and money.

LATEST CPA TECHNOLOGY

Information Technology (IT) has evolved from a misunderstood cost center to a valuable vehicle for business transformation . Because IT is the central nervous system driving your business success, we partner with companies who are looking for experience with connected data sources and new IT capabilities.

FINANCIAL RESOURCES AND NEWS

Providing up-to-date tax news and the latest in analysis, interviews, and videos on money, accounting, financial management, business software, and more!

New Home Equity Tax Loophole Approved by IRS

If you're slightly confused regarding how the Tax Cuts and Jobs Act affects your personal tax strategy, you're not alone. One of the primary causes...

New Tax Laws Open Cash Method of Accounting for More Businesses

Business owners are now reviewing the repercussions of the Tax Cuts and Jobs Act of 2017 or are planning to do so soon. Learning about how these...

Surviving an IRS Tax Audit

There are few events that cause a business owner or individual to cringe more than receiving a dreaded IRS tax audit notice in the mail. For those...

BEWARE: New Tax Scams in 2018

The tax season is upon us once again, and with it comes the emergence of tax schemes both old and new. New tax scams in 2018 are as numerous and...

Tax Cuts and Jobs Act: Major Change to Entertainment and Meal Deductions for Businesses

With its effect being immediate and unanswered questions lingering, the Tax Cuts and Jobs Act largely eliminates the deduction for entertainment...

How Would a Government Shutdown Affect Your 2017 Taxes?

With the recent government shutdown and the opening of the 2018 tax season coming soon, did you wonder how that would affect the filing your 2017...

ACT NOW

Contact one of our accounting, tax planning, or business advisory specialists today to tap into tomorrow’s insights today. Everything Lawhorn CPA Group does is to help your business improve results by providing business services you need when you need them.